If we do pay or return an overdraft item for you, a $35 overdraft fee applies for each item, up to five fees per day. Your available balance can be overdrawn by up to $5 without incurring any fees. With this service, if you don’t have enough available funds in your account, your debit card will be declined at the time of the swipe.Īll other overdrawn transactions may be considered for payment at our discretion. All of our customers automatically receive our Standard Overdraft Service. That’s why we give you different options to choose from. We think you should be able to decide how you’d like your account to work if this happens. Remember, TD Bank’s online and mobile banking services, TD Stores, ATMs and TD Customer Service all offer you up-to-date information about your available balance, and more, to help you manage your accounts anytime, anywhere.Īt TD Bank, we understand that sometimes the funds available in your account are not quite enough to cover a transaction. When the day is done, Sam’s end-of-day available balance is $1975. Lastly, any interest earned or other fees generated by the end of the day, such as non-TD ATM fees, Monthly Maintenance fees, or Paper Statement fees will then be applied. When there are multiple checks, they will be processed by check number, from lowest to highest. Checks drawn on Sam’s account will all process as if they occurred at 11 pm. If Sam had any Wire, Overdraft, or Return Item fees, they would be sorted here, based on the time they were processed by TD Bank. Note that pending transactions will impact the available balance, but won’t incur any potential overdraft fees until after the items clear. All transactions are processed at the end of the business day and are sorted in the following manner.įirst, we process transactions based on the date and time that the transaction occurred. Now, let’s look at how Sam’s banking transactions were processed overnight to help you understand what you may see in your own account. You can find out more by reviewing TD Bank’s Personal Deposit Account Agreement. New accounts may have to wait longer for their funds to be available. Sam receives immediate availability for cash deposits, and a $100 courtesy for the total value of all checks he deposited. On the way home from work, Sam stops by TD Bank to make a deposit: a $200 check, $50 cash, and a $300 check.

You can check your pending transactions online, on your mobile phone, at a TD Bank store, or by calling TD Customer Service.

Since this money has already been spent, it will no longer be considered available. He also purchases the new bestseller and pays with his debit card, which reduces his available balance by $20 immediately, and will appear in his Pending Transactions. His available balance is reduced by $5 right away, and the purchase appears in his Pending Transactions. While running errands at lunch, Sam buys a cup of coffee using his debit card. Sam should consider this money as unavailable for any future purchases and keep enough money in his account for those payments to process to avoid overdrafts. Sam remembers he wrote a personal check for $100 to his babysitter and has a $50 check to his niece. Sam’s available balance doesn’t reflect any checks he’s written or any scheduled bill payments that have not yet cleared. He sees that a $500 direct deposit has been made, and his available balance shows as $2000. Sam begins the day by using online banking to check his account.

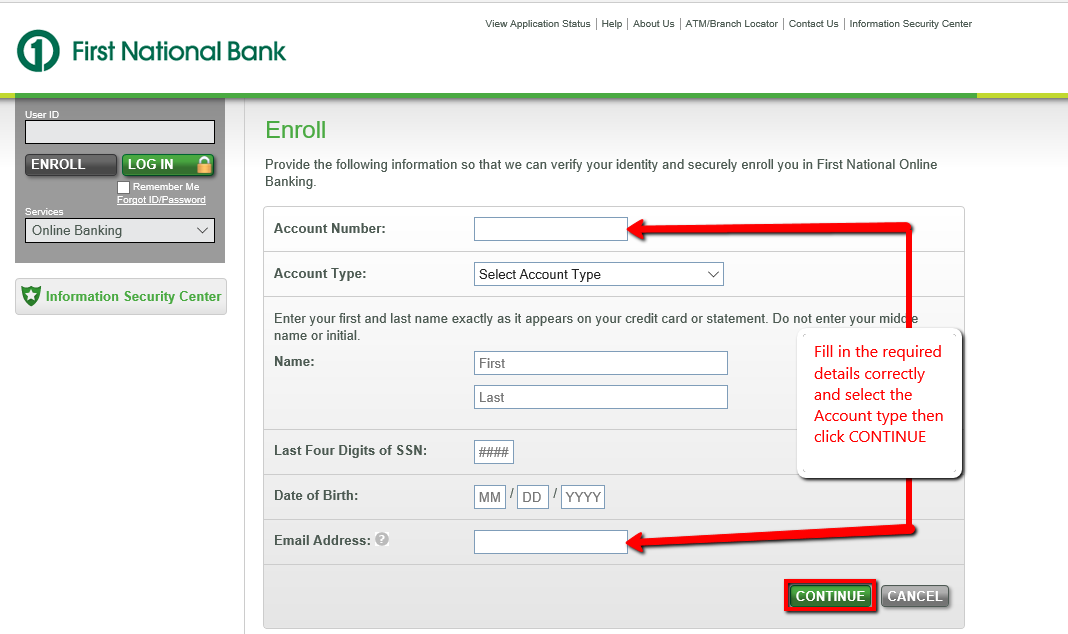

TD BANK ONLINE LOGIN PERSONAL BANKING HOW TO

Let’s examine how Available Balance works by looking at a typical customer’s day so you can better understand how to manage your own checking account and avoid overdrafts. It’s important to remember that your available balance may not be the same as the balance on your statement, due to pending transactions.

Different types of transactions affect your available balance in different ways.

Your available balance tells you how much money is currently available for you to spend. Loans subject to credit approval.If you’re like most TD Bank customers, you use a combination of cash, checks, online banking, and your debit card to pay bills and make everyday purchases. Please contact TD Bank NA if you have any questions. TD Bank NA may utilize third-party providers during the servicing of your loan. You may file complaints and obtain further information about the servicer by contacting the New York State Department of Financial Services Consumer Assistance Unit at 1-80 or by visiting the Department's website at Mortgage and Home Equity Servicing Fee Schedule For loans secured by New York property: TD Bank NA is registered with the Superintendent of New York.

0 kommentar(er)

0 kommentar(er)